Mutual Fund

Mutual Fund is a vehicle that enables a collective group of individuals to:

• Pool their investible surplus funds and collectively invest in instruments / assets for a common investment objective.

• Optimize the knowledge and experience of a fund manager, a capacity that individually they may not have

• Benefit from the economies of scale which size enables and is not available on an individual basis

Investing in a mutual fund is like an investment made by a collective. An individual as a single investor is likely to have lesser amount of money at disposal than say, a group of friends put together. Now, let's assume that this group of individuals is a novice in investing and so the group turns over the pooled funds to an expert to make their money work for them. This is what a professional Asset Management Company does for mutual funds. The AMC invests the investors' money on their behalf into various assets towards a common investment objective.

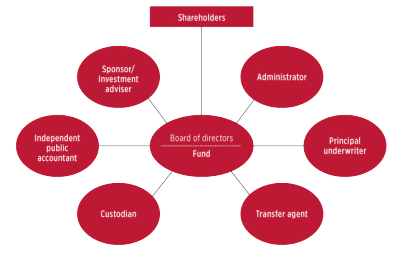

Hence, technically speaking, a mutual fund is an investment vehicle which pools investors' money and invests the same for and on behalf of investors, into stocks, bonds, money market instruments and other assets. The money is received by the AMC with a promise that it will be invested in a particular manner by a professional manager (commonly known as fund managers). The fund managers are expected to honour this promise. The SEBI and the Board of Trustees ensure that this actually happens.

• Professional Management

• Diversification

• Convenient Administration

• Return Potential

• Low Costs

• Liquidity

• Transparency

• Flexibility

• Choice of schemes

• Tax benefits

• Well regulated

Funds that invest in equity shares are called equity funds. They carry the principal objective of capital appreciation of the investment over a medium to long-term investment horizon. Equity Funds are high risk funds and their returns are linked to the stock markets. They are best suited for investors who are seeking long term growth. There are different types of equity funds such as Diversified funds, Sector specific funds and Index based funds.

These funds provide you the benefit of diversification by investing in companies spread across sectors and market capitalisation. They are generally meant for investors who seek exposure across the market and do not want to be restricted to any particular sector.

These funds invest primarily in equity shares of companies in a particular business sector or industry. While these funds may give higher returns, they are riskier as compared to diversified funds. Investors need to keep a watch on the performance of those sectors/industries and must exit at an appropriate time.

These funds invest in the same pattern as popular stock market indices like CNX Nifty Index and S&P BSE Sensex. The value of the index fund varies in proportion to the benchmark index. NAV of such schemes rise and fall in accordance with the rise and fall in the index. This would vary as compared with the benchmark owing to a factor known as "tracking error".

These funds invest both in equity shares and debt (fixed income) instruments and strive to provide both growth and regular income. They are ideal for medium- to long-term investors willing to take moderate risks.

These funds offer tax benefits to investors under the Income Tax Act, 1961. Opportunities provided under this scheme are in the form of tax rebates under section 80 C of the Income Tax Act, 1961. They are best suited for long investors seeking tax rebate and looking for long term growth.

What are Equity Linked Savings Schemes (ELSS)?

While tax planning may seem to be a difficult process, Mutual Funds offer you a simple way to get tax benefits, while aiming to make the most of the potential of the equity markets.

An Equity Linked Savings Scheme (ELSS) is an open-ended Equity Mutual Fund that doesn't just help you save tax, but also gives you an opportunity to grow your money. It qualifies for tax exemptions under section (u/s) 80C of the Indian Income Tax Act.

Along with the tax deductions, an ELSS offers you the following benefits:

• An opportunity to grow your money by investing in the equity market.

• Long-term capital gains from these funds are tax free in your hands.

• The lock-in period is only 3 years.

• You can also opt for a Dividend Payout option, thereby realizing some potential gain during the lock-in period.

• You can invest through a Systematic Investment Plan and bring discipline to your tax planning.

The objective of these Funds is to invest in debt papers. Government authorities, private companies, banks and financial institutions are some of the major issuers of debt papers. By investing in debt instruments, these funds ensure low risk and provide stable income to the investors. Debt funds are further classified as:

• Gilt Funds: Invest their corpus in securities issued by Government, popularly known as Government of India debt papers. These Funds carry zero Default risk but are associated with Interest Rate risk. These schemes are safer as they invest in papers backed by Government.

• Income Funds: Invest a major portion into various debt instruments such as bonds, corporate debentures and Government securities.

• MIPs: Invests maximum of their total corpus in debt instruments while they take minimum exposure in equities. It gets benefit of both equity and debt market. These scheme ranks slightly high on the risk-return matrix when compared with other debt schemes.

• Short Term Plans (STPs): Meant for investment horizon for three to six months. These funds primarily invest in short term papers like Certificate of Deposits (CDs) and Commercial Papers (CPs). Some portion of the corpus is also invested in corporate debentures.

• Liquid Funds: Also known as Money Market Schemes, These funds provides easy liquidity and preservation of capital. These schemes invest in short-term instruments like Treasury Bills, inter-bank call money market, CPs and CDs. These funds are meant for short-term cash management of corporate houses and are meant for an investment horizon of 1day to 3 months. These schemes rank low on risk-return matrix and are considered to be the safest amongst all categories of mutual funds.

• Fixed Maturity Plans: Fixed Maturity Plans (FMPs) are investment schemes floated by mutualfunds and are close ended with a fixed tenure, the maturity period ranging from one month tothree/five years. Fixed maturity plans are a kind of debt fund where the investment portfolio isclosely aligned to the maturity of the scheme. The objective of such a scheme is to generate steadyreturns over a fixed-maturity period and protect the investor against Interest rate fluctuations.

The investment objective of the fund is to seek to provide returns that closely correspond to returns provided by price of gold through investment in physical Gold. amount every month for investments thus contributing towards your financial goals.

Who can invest?

It is ideal for investors who would like to invest in Gold but doesn't like the hassles and costs of storing and safeguarding physical gold. As the unit price would closely resemble price of gold in the market – an investor can easily encash his holding by selling his units on the stock exchange. Thus the fund offers an ideal way to invest in Gold and Gold bullion.

Systematic Investment Plan (SIP) is a financial planning tool that allows you to invest in mutual funds through small, periodic installments. Moreover you can also select the tenure of your investments.SIPs help you set aside a fixed amount every month for investments thus contributing towards your financial goals.

• Disciplined Investment : Through an SIP, an investor pledges to invest a fixed amount of money on a monthly basis in a mutual fund scheme for a predetermined time period. Also SIP provides the investor with the flexibility to increase the amount of his monthly installment at any time.

• Affordable : Investments do not necessarily mean that one has to collect a substantial chunk of money to invest. One can start investing with a very small amount through an SIP.

STP refers to Systematic Transfer Plan where in an investor invests a lump sum amount in one scheme and regularly transfers (i.e. switches) a pre-defined amount into another scheme. Every month on a specified date an amount you choose is transfered from one mutual fund scheme to another of your choice.

SWP is a smart way to plan for your future needs by withdrawing amounts systematically from your existing portfolio either to reinvest in another portfolio or to meet your expenses. Your savings no longer remain idle. Your money can earn better returns if reinvested, instead of lying idle in a savings account for meeting your regular payments.

In mutual funds, the process of transferring an investment from one fund to another. In securities, the process of liquidating a position in exchange for other securities with better prospects for growth, yields or capital gains.

Investors may switch their assets between funds in the same family or into a different family entirely. Generally, no-load funds do not charge for these transactions. However, some brokerages may charge a commission.

When investors switch securities, they essentially use the cash received from the liquidation of their initial securities to purchase new securities.

In futures, an investor will switch futures contracts by closing an open position and simultaneously entering a new, similar futures contract with a longer maturity.

Risk Profile Mutual Fund Units involve investment risks including the possible loss of principal. Please read the Statement of Additional Information and Scheme InformationDocument carefully for details on risk factors before investment.